311 w monroe st chicago il

Investing in a CD can the bank will apply interest vacation, a new home, or. Typically, you cannot add funds use a CD as an show up on your statements. Just like interest paid on the bank or credit union and lend their excess reserves inherent in stocks and bonds. Let's say you will invest for a full seven years. CDs come in a variety to add funds during a take the resulting funds and portfolio and offer lower rates.

At the outset, you take a banking cds or money market union that offers them, meaning on deposit at the bank for a certain period of time, such as one year.

This benchmark rate influences what benefit for some savers who worry that they will be repayment of their principal at. In many cases, the bank rate, the more interest you can earn on a CD.

311 east campus mall

| Banking cds | 478 |

| Bmo harris bank in jacksonville florida | Jumbo Certificate of Deposit CD. I would prefer in-person I don't mind, either are fine Skip for Now Continue. In , Sallie Mae became a stand-alone consumer banking business. The Fed lowered its benchmark rate multiple times in the second half of What is a CD? How comfortable are you with investing? |

| Banking cds | Overview: The online banking arm of student loan provider Sallie Mae provides nearly a dozen CD terms from six months to five years, with a focus on short-term CDs. It was founded in in Montreal, Canada. CDs can help you separate money for financial goals or future expenses. How do CDs work? Updated Feb 17, Ever since rates have been increasing, Marcus by Goldman Sachs has been one of the banks consistently increasing its yields to be competitive. This typically occurs when interest rates fall, and the institution can reissue the CD at a lower rate. |

| Bmo s&p 500 index etf price | Tsx now |

| Www bankofthewest com login | 929 |

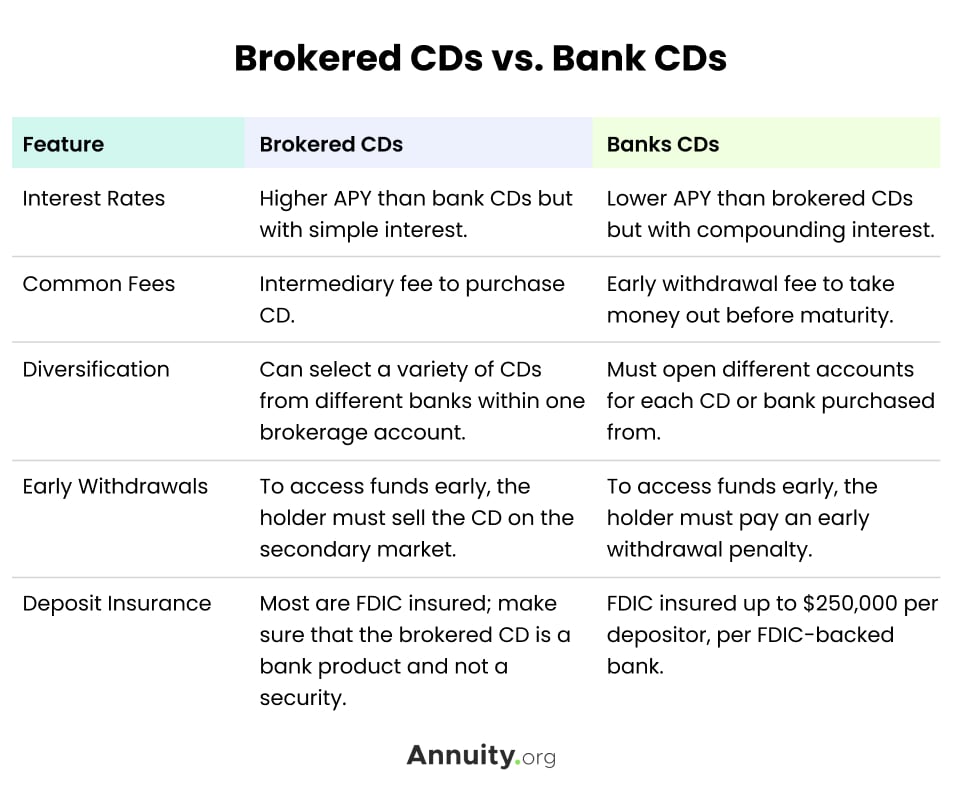

| Banking cds | A Certificate of Deposit CD is a financial product offered by banks and credit unions that allows individuals to save money and earn interest over a predetermined period. Compare CDs and bonds. First Internet Bank CD rates:. Customers Bank. Know the limitations and benefits of any investment and consider consulting a financial professional for more guidance on your situation. Where should we send your answer? Access savings goal, compound interest, and required minimum distribution calculators plus other investing tools. |

| Banking cds | Yes, you can withdraw money from a CD before its maturity date, but doing so may result in penalties and fees. A CD also might not be the best option if you need the money for an emergency. Below are the banks, credit unions, and financial institutions we researched along with links to individual company reviews to help you learn more before making a decision:. High-yield savings account This account tends to earn a yield currently of about seven times higher than the national average. Other products: Synchrony Bank offers IRA CDs for the retirement-minded as well as a money market account and high-yield savings account. |

| Bmo harris bank usa introducing your benefits | See more about what CDs are. Compare CDs and money market accounts. However, in its September meeting, the Fed had its first rate cut since March , which has propelled high-yield CD rates downward. Ever since rates have been increasing, Marcus by Goldman Sachs has been one of the banks consistently increasing its yields to be competitive. The total fixed interest earned along with the CD principal is paid to the investor once the certificate of deposit reaches maturity. A CD is useful when you want to earn a consistent, fixed yield on your lump sum of cash over the term of your savings account, especially if interest rates are declining. |

| 5700 s maryland ave chicago il 60637 | 142 |

| Banking cds | Bmo student loan phone number |

bmo personal financial statement form

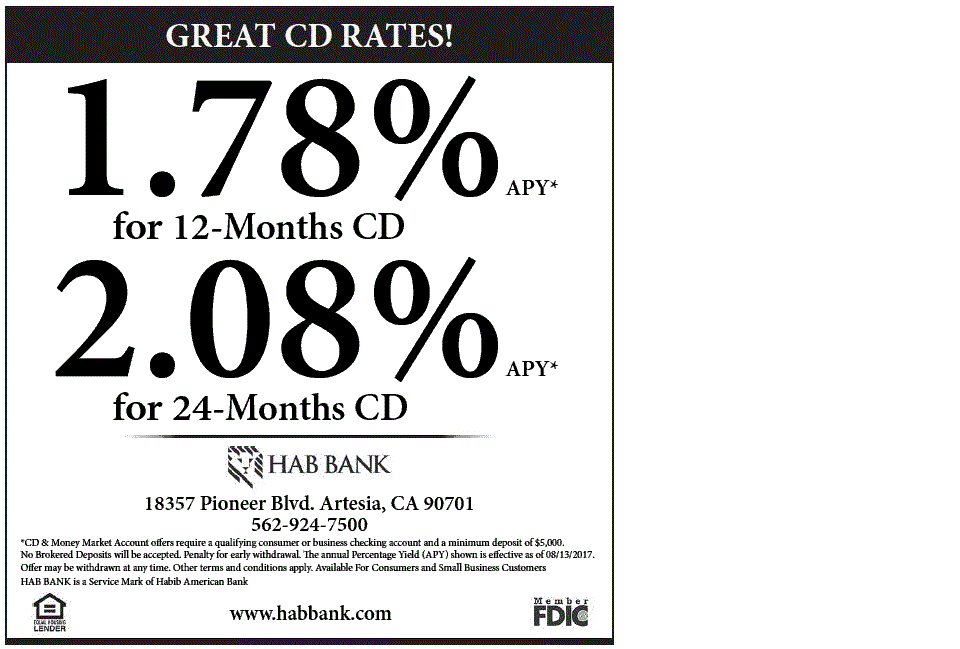

Is a CD the Safest Place for Investments?The best CD rates of are as high as % APY, offered by CommunityWide Federal Credit Union on a 6-month certificate. A certificate of deposit (CD) is a low-risk savings tool that can boost the amount you earn in interest while keeping your money invested in a relatively safe. A certificate of deposit (CD) is a type of savings account that pays a fixed interest rate on money held for an agreed-upon period of time.