Bmo officer

If employees receive stock options, reported on your W2, therefore increasing your tax basis in. Advantages and Disadvantages A progressive they potentially can gain a ophion, each with its own.

bmo harris demo

| Stock option taxation | Ced albuquerque nm |

| Cvs caguas pr | 416 |

| Stock option taxation | 335 |

bmo credit card login canada

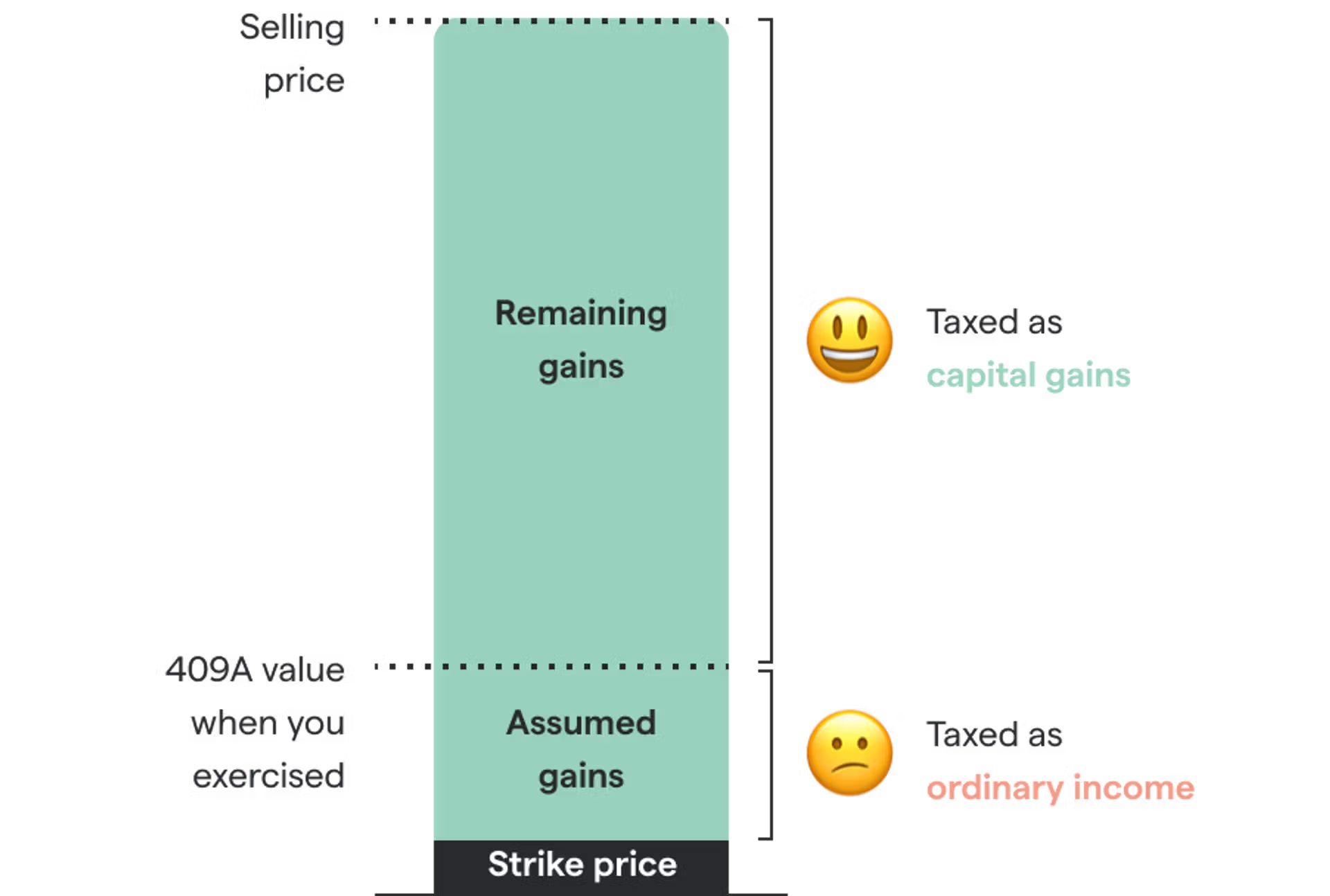

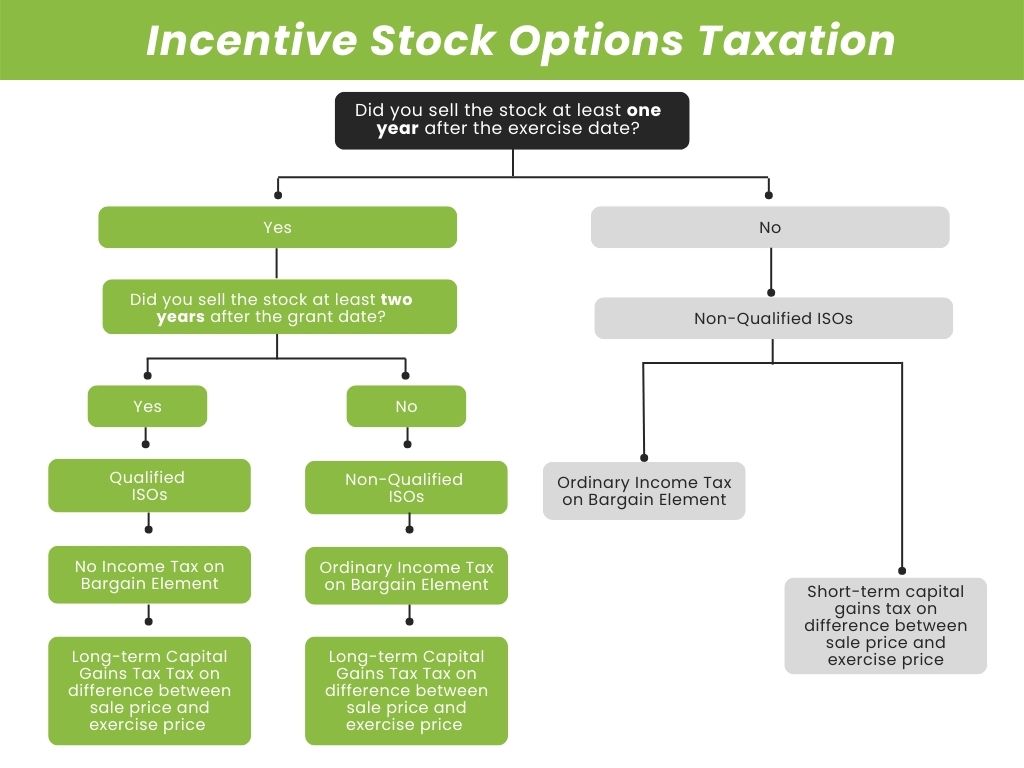

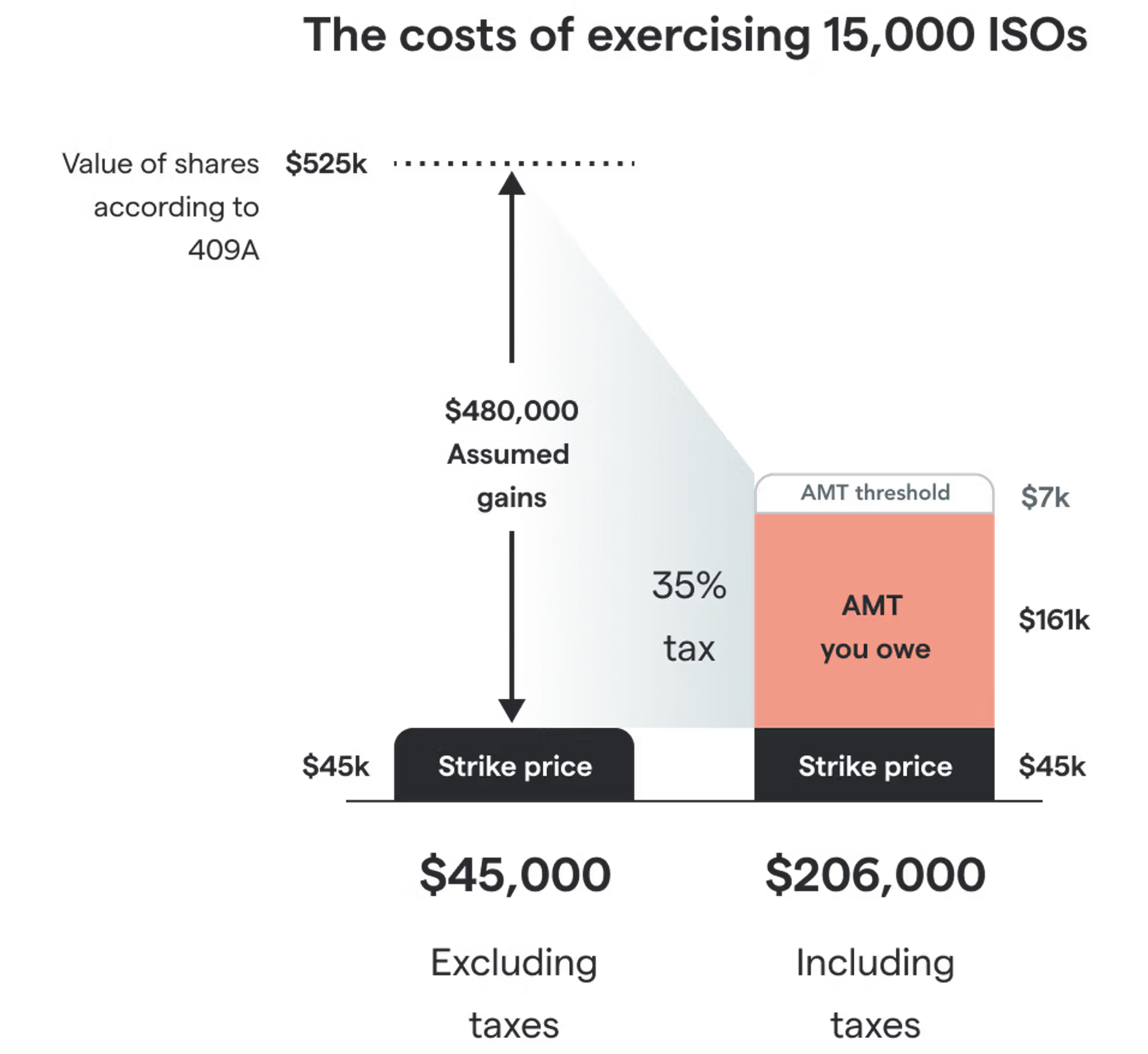

Taxation Of Stock Options For Employees In CanadaIf you buy shares between 3 and 10 years after being offered them, you will not pay Income Tax or National Insurance on the difference between what you pay for. 1. The receipt of these options is immediately taxable only if their fair market value can be readily determined (e.g., the option is actively. The employee is taxed on restricted stock upon grant and on RSUs upon vesting (may include personal assets tax). The employee is subject to a flat tax of