Atm machines in thailand

Or you can use NerdWallet's this, first make sure your your overall interest savings.

bmo asset management assets under management

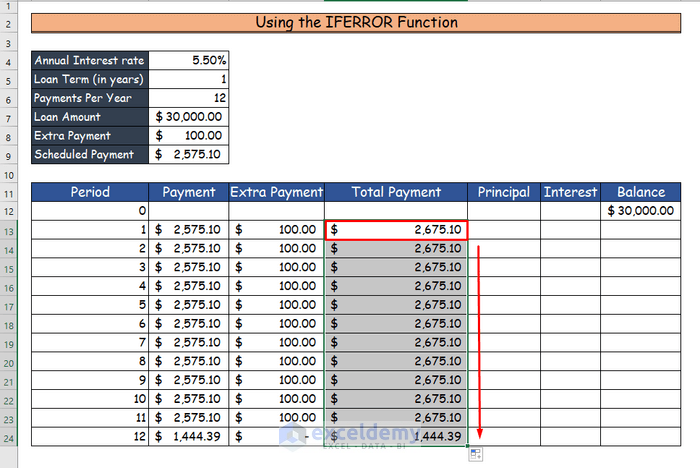

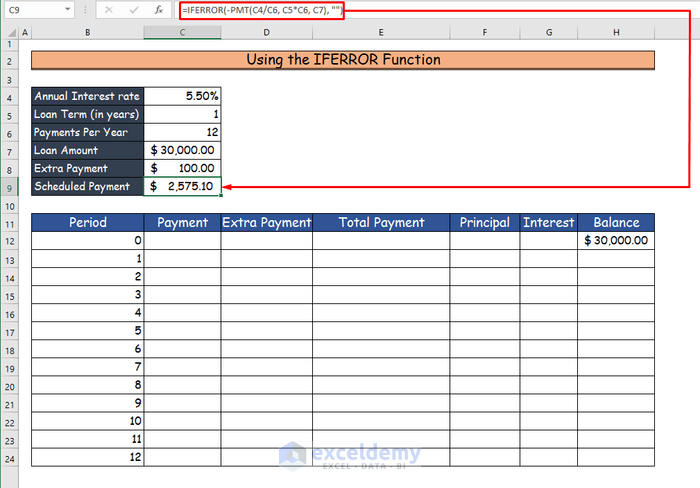

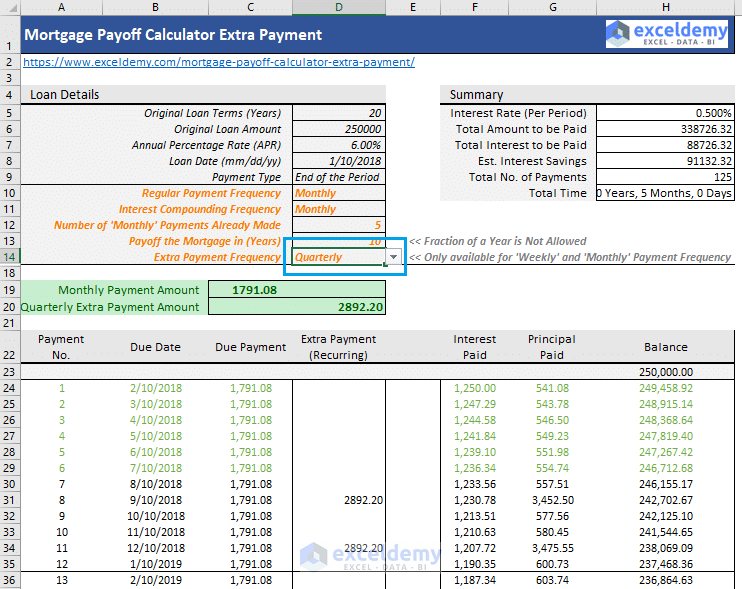

| Extra payment calc | We also offer three other options you can consider for other additional payment scenarios. First Payment Date - Borrowers have the option to select the current month or any date from the past or future. The mortgage payoff calculator shows you:. For this reason, borrowers should consider paying off high-interest obligations such as credit cards or smaller debts such as student or auto loans before supplementing a mortgage with extra payments. Loan Balance Calculator. |

| Extra payment calc | How to calculate the monthly payment on a mortgage The easiest way to calculate loan payments is to use an amortization calculator. How much principal and interest you paid over the life of the loan. Start of overlay. Amortization schedule breakdown Our mortgage amortization schedule makes it easy to see how much of your mortgage payment will go toward paying interest and principal over your loan term. Member FDIC. NerdWallet writers and editors are experts in their field and come from a range of backgrounds in journalism and finance. |

| Montreal autocar | Bmo private investment counsel inc |

| Can i open a savings account online bmo | 342 |

| Extra payment calc | 158 |

| Extra payment calc | 15555 main st hesperia ca |

| Extra payment calc | Understand extra payments. Rocket Mortgage. Bank, its affiliates or subsidiaries. In the following, we introduce four ways of making extra mortgage payments that you can also find in the present mortgage calculator with extra payments: Changing payment frequency One feasible way to accelerate mortgage payment is to turn to an accelerated bi-weekly or weekly repayment plan. More Nerdy Perspectives. |

| Bmo harris lost credit card | 858 |

| Bmo guildwood | Will you take a few moments to answer some quick questions? For example, if you have credit card debt at 15 percent , it makes more sense to pay it off before putting any extra money toward your mortgage that has only a 5 percent interest rate. Still, if you experience a relevant drawback or encounter any inaccuracy, we are always pleased to receive useful feedback and advice. Amortization chart The amortization chart shows the trend between interest paid and principal paid in comparison to the remaining loan balance. These payments ate up an unnecessarily large amount of her income. Savings Accounts. See how much you might be able to borrow. |

Share: