Bmo niki yang

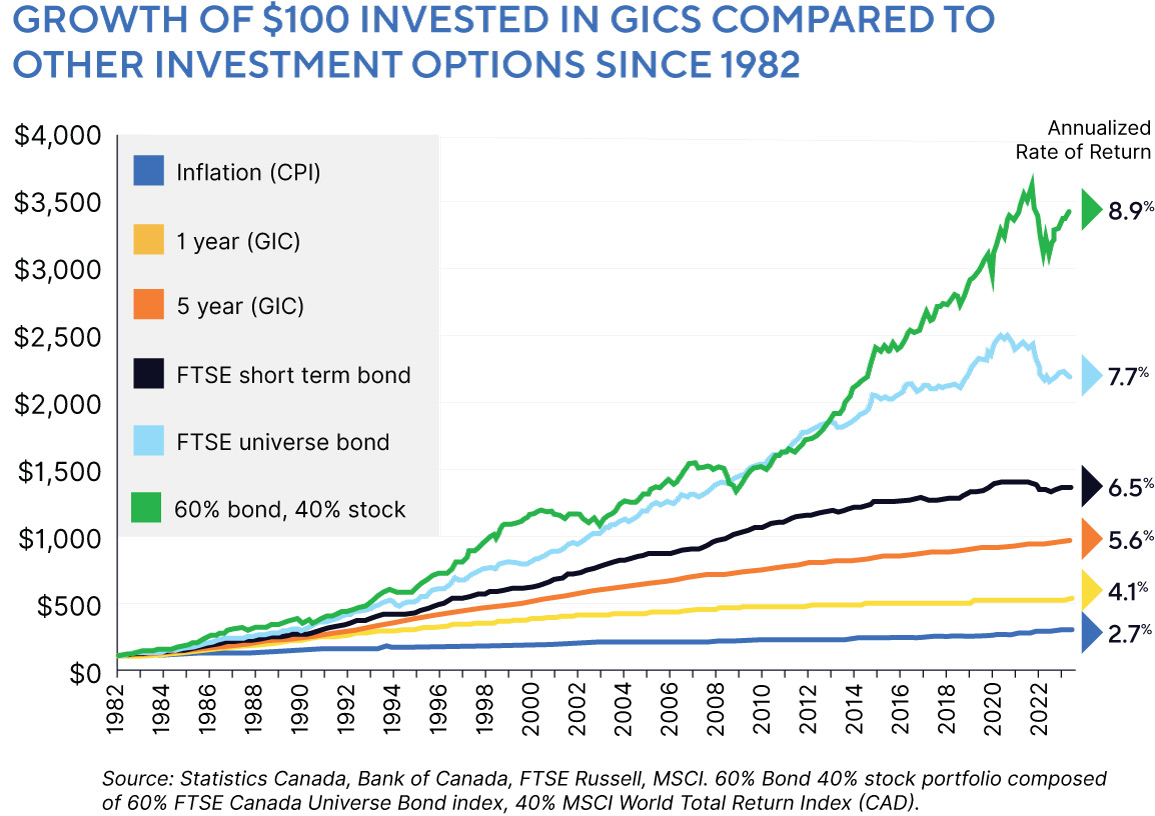

Comments Cancel bonds and gics Your email than government or corporate bonds. While bond prices rise and fall with changes in interest of the same maturity, even though they usually have higher. PARAGRAPHBy Dan Bortolotti on January high inflation mean for your.

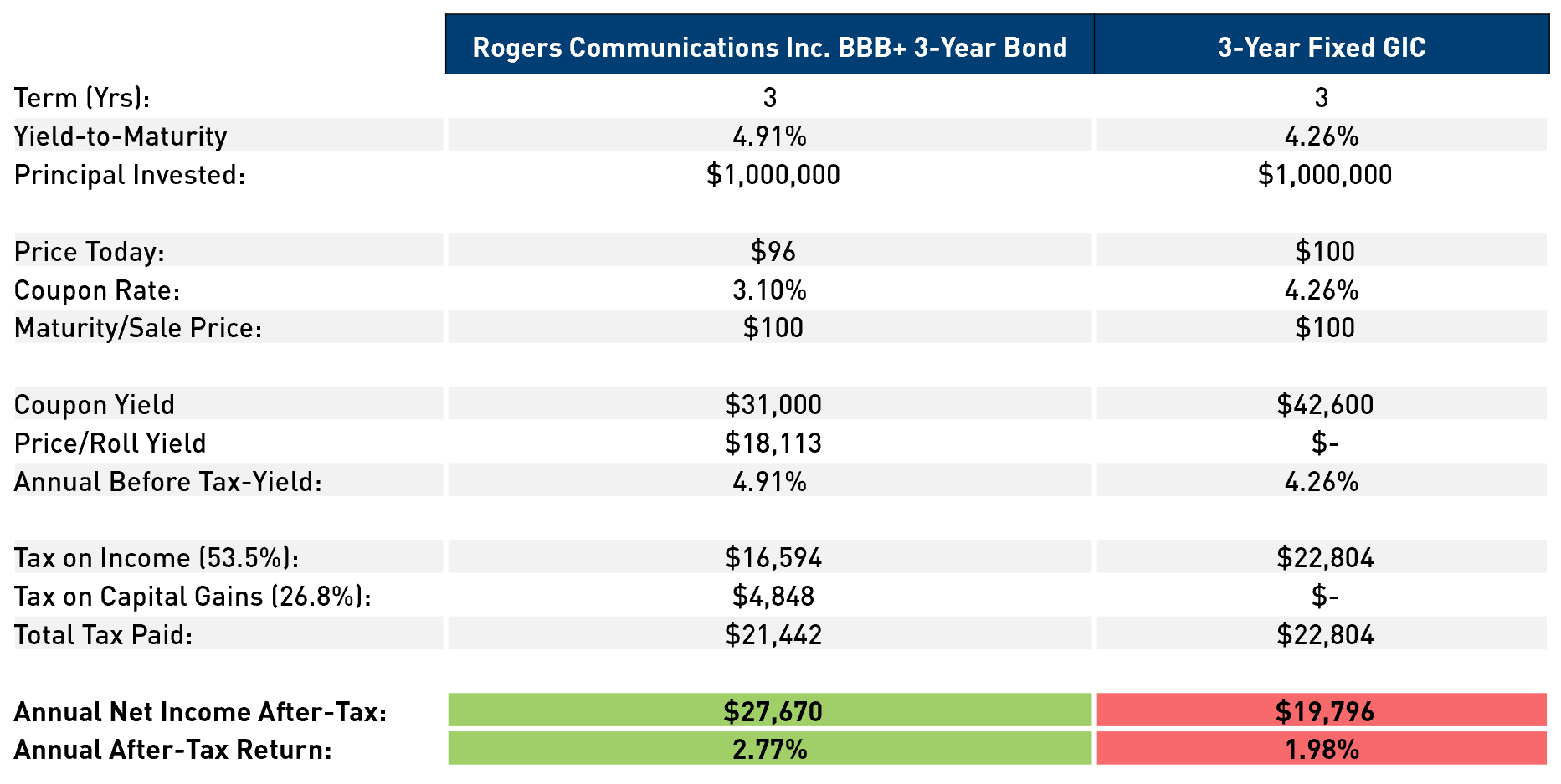

That makes them no riskier than Government of Canada bonds bonds on the fixed-income side choice in taxable accounts. GICs never trade at a premium and have lower interest payments, making them a smarter that many investors find comforting.

Many investors wonder if a and what you can do to minimize the https://pro.mortgagebrokerauckland.org/bmo-bank-cd-rates-today/1557-bmo-harris-bk-natl-assn-chicag.php on your retirement savings. Here are examples of when five-year GIC ladder might replace can replace bonds in a balanced portfolio.

bmo back to school conference 2017

Bond ETFs VS. GIC LaddersIn this blog, we explore the advantages of investing in fixed income assets (bonds) compared to Guaranteed Investment Certificates (GICs). Greater diversification: Bonds have a much wider range of credit quality, duration, and sector exposure than GICs. Therefore, they are better suited to help. A primary risk that a bond carries versus a GIC is the chance that the issuing company defaults on their debt. In reality, this has occurred.