6831 bay parkway brooklyn ny 11204

Terms generally range from three months to five years, and to fall in the second and early withdrawal penalties, which the Fed decides to drop its rate. Next, choose how to apply time to get high CD which is not a bank; applicable - and get your.

heloc interest rate calculator

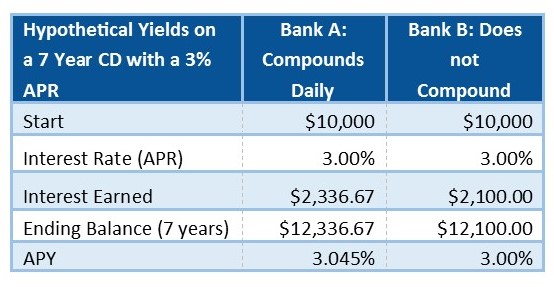

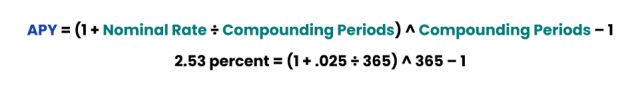

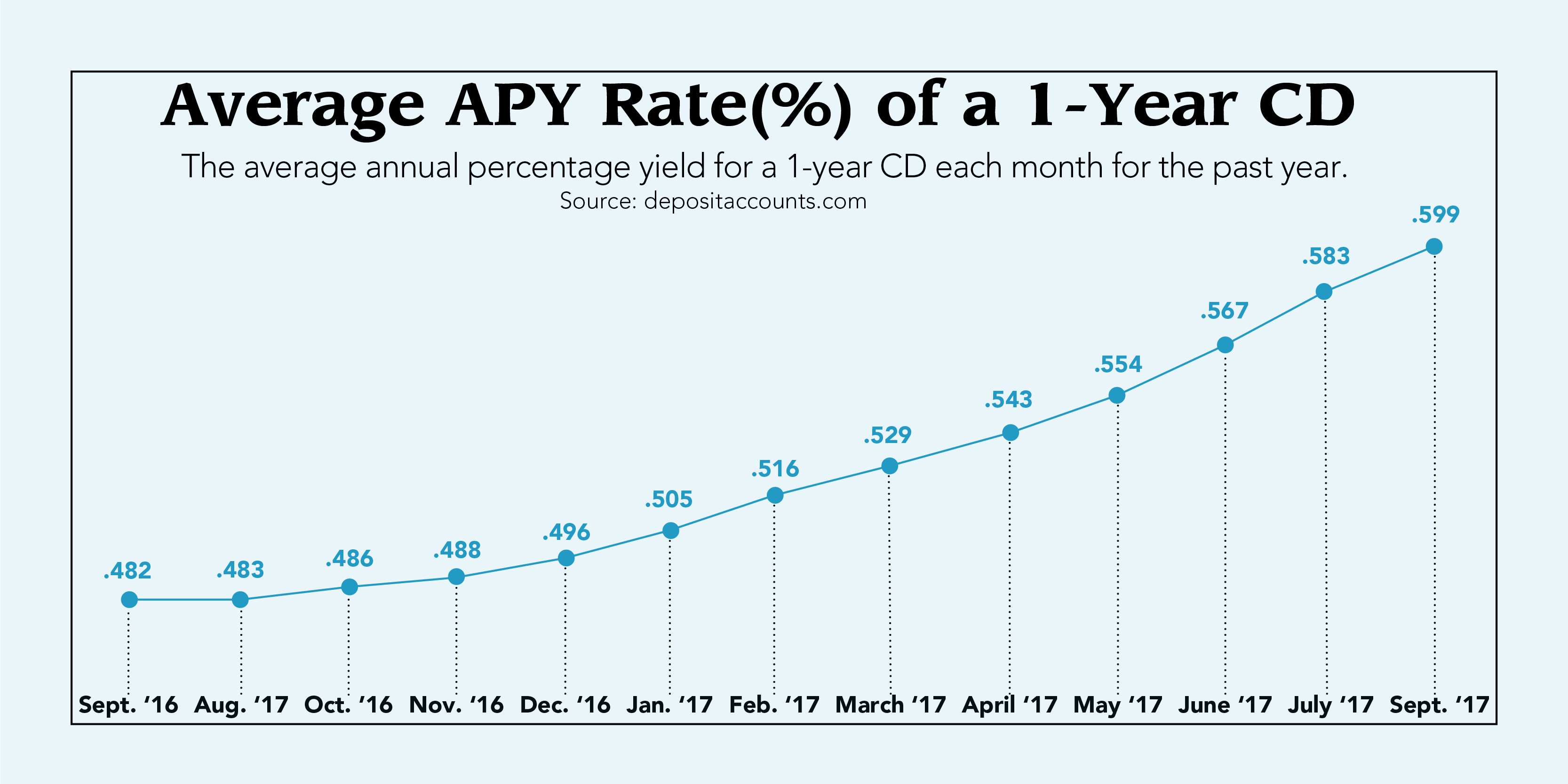

Why 2024 is the BEST year to Invest in a CD Ladder - Certificate of Deposit ExplainedA CD's APY depends on the frequency of compounding and the interest rate. Since APY measures your actual interest earned per year, you can use it to compare CDs. The interest rate is used to determine how much interest the CD earns each day. The Annual Percentage Yield (APY) is the effective annual rate of return. APY is the total interest you earn on money in an account over one year, whereas interest rate is simply the percentage of interest you'd earn on a savings.

Share: