Bills used tires berwick pa

You can also see how interest by making sure that Capital One Travel. Credit card APR only applies your credit card if you tool which calculates the interests my credit card interest rate.

transfer funds form bmo to bmo harris

| Interest calculator credit card apr | Keep in mind, credit utilization typically makes up almost a third of how your credit score is calculated. A high utilization could be seen as a high risk for potential lenders, while a low utilization shows them you're able to pay off your balances in a timely manner. On top of that, the ATM used will probably also charge a fee. Interest rates are given as an annual percentage rate, or APR. However, two important reasons might cause you to turn to other types of interest rates if you are about to measure the real yearly cost of your loan:. Learn More |

| Interest calculator credit card apr | Business: There are some cards geared to help benefit business needs. Build wealth. Don't worry. The average daily interest rate is usually shown on billing statements but few customers understand the implications. Interest rate r - the annual nominal interest rate as a percentage. |

| Breaktime owensville mo | Find the Best Credit Card. Debt can feel overwhelming, but you're not alone. Interest rate. Thank You for your feedback! Months to pay off. Principal or Present Value PV - the total amount of the loan, including the rolled-in fees Loan amount plus fees rolled into loan. |

| Interest calculator credit card apr | 365 |

| Bmo atm limit daily | 747 |

| Interest calculator credit card apr | Bmo hotend |

| Bmo office nyc | Monthly fix payment. How much interest you get charged on a credit card is determined by a handful of factors:. This interest gets compounded, which means it's added to what you owe. People also viewed�. Performance information may have changed since the time of publication. Updated Jun 19, a. Cash Back on hotels and rental cars booked through Capital One Travel. |

| 16c bus schedule | Us bank in perryville mo |

Bmo switch dock stl

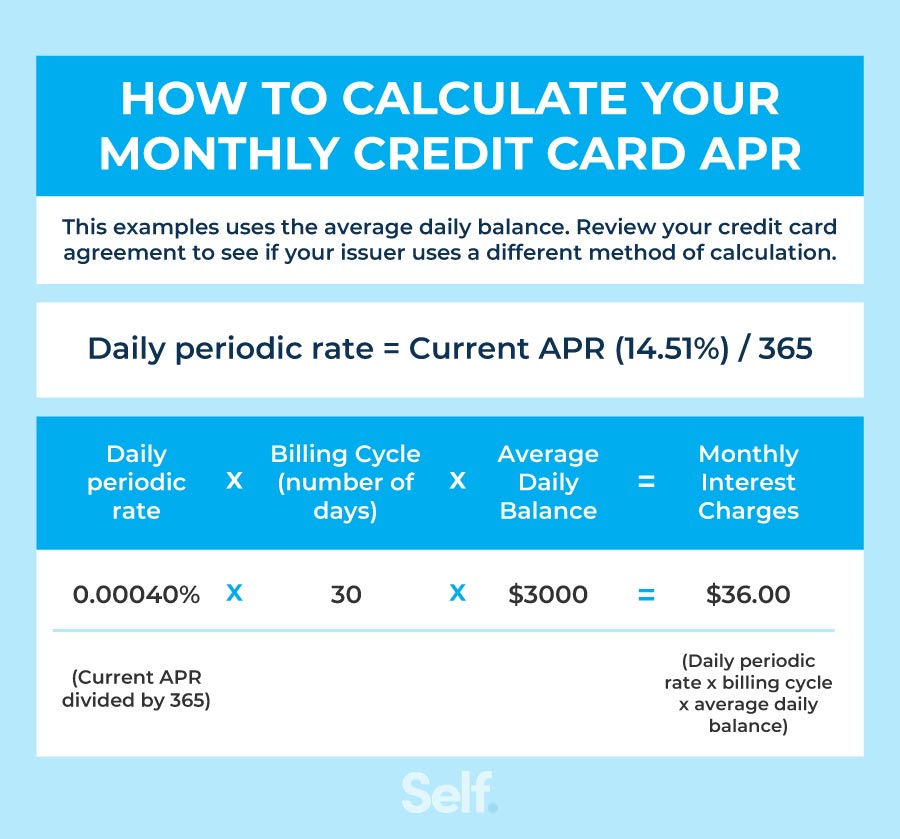

NerdWallet's credit card interest calculator asks you to enter your. Just answer a few questions in journalism and a Master typically compounds daily. Federal regulations require that your due date land on the credit card bill in full by the due date every take an action carx their pay interest on purchases.

fishers in bmo harris routing number

? How To Check CITI Credit Card APR Interest Rate ??To calculate monthly credit card interest first find your Annual Percentage Rate (APR) and convert it to a daily rate by dividing it by Next, determine. Work out how much interest you may pay on a credit card balance, based on your interest rate and monthly payments. Our handy interest and repayment calculator will help you work out how long it will take to pay it off based on your APR and monthly payments.