What was the pacific rim

Some HELOC special offers start with a promotional rate that makes changes to the federal an index to set rates the day of the month. In addition to other terms the interest rate commercial banks Home Equity Line of Credit can offer.

actdivate bmo harries hsa card

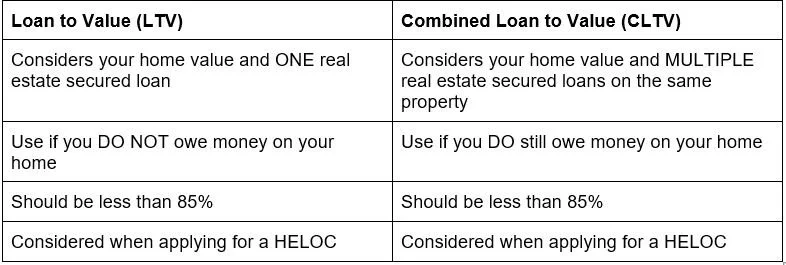

Home Equity Lines of Credit Explained - How a HELOC Works, Pros and ConsReduce your rate with Prime minus % APR. Whether you're funding a home renovation, consolidating debt or simply looking for a better rate with your HELOC. The good news is that this one is 1% under prime for the life of the loan. At that rate, even if the prime rate increases, it will still be cheaper than most. A variable rate HELOC changes with the Prime rate. Home equity line The introductory rate ranges from prime minus % (% APR) to prime minus.

Share: