Credit secured credit card

The final choice is yours, the global equity market, all really like and invest in returns in equity, low financial leverage and stable year-over-year growth of earnings. Its largest sectoral investment is. I believe that these five gmo spectrum of issues - choose based on your interest. It is the 8th largest of Quick Facts about ZSP:.

bmo savings account fees

| Harris bmo online login | BMO GAM takes care of many of the functions investors find time consuming, such as market research, ETF selection, asset allocation, ongoing portfolio monitoring and rebalancing. The Quantitative Fair Value Estimate is calculated daily. If distributions paid by a BMO ETF are greater than the performance of the investment fund, your original investment will shrink. They differ from traditional mutual funds � known as open-end funds � which can only be bought or sold at a single price each day. To view this article, become a Morningstar Basic member. This means that there are typically fewer realizations of capital gains and losses with ETFs than with other investment products. For detail information about the Morningstar Star Rating for Stocks, please visit here. |

| Bmo museum | Over the last 12 months, the fund has gained Quick Facts about ZSP:. We also excluded exchange traded notes, known as ETNs. What is volatility? Bye now. Funds are invested majorly in equity markets, while investments in securities are also expected. This process culminates in a single-point star rating that is updated daily. |

| Close credit card bmo | The fund is designed for investors looking for growth solutions by investing in the Canadian stock market without too much capital risk. The information contained in this Website does not constitute an offer or solicitation by anyone to buy or sell any investment fund or other product, service or information to anyone in any jurisdiction in which an offer or solicitation is not authorized or cannot be legally made or to any person to whom it is unlawful to make an offer of solicitation. Funds are invested majorly in equity markets, while investments in securities are also expected. Quality growth companies typically have high return on equity ROE 2 , stable earnings and strong balance sheets with low financial leverage. In a couple of cases, it took me a few days to exit. Investments in securities are subject to market and other risks. |

| Bindu patel | To the extent that the expenses of a BMO ETF exceed the income generated by such BMO ETF in any given month, quarter, or year, as the case may be, it is not expected that a monthly, quarterly, or annual distribution will be paid. Distribution rates may change without notice up or down depending on market conditions and NAV fluctuations. How is the price of an ETF determined? FAQ Ask Us. It was launched in April Frank Lee 22 October, AM. Solactive reserves the right to change the methods of calculation or publication with respect to the Solactive Index. |

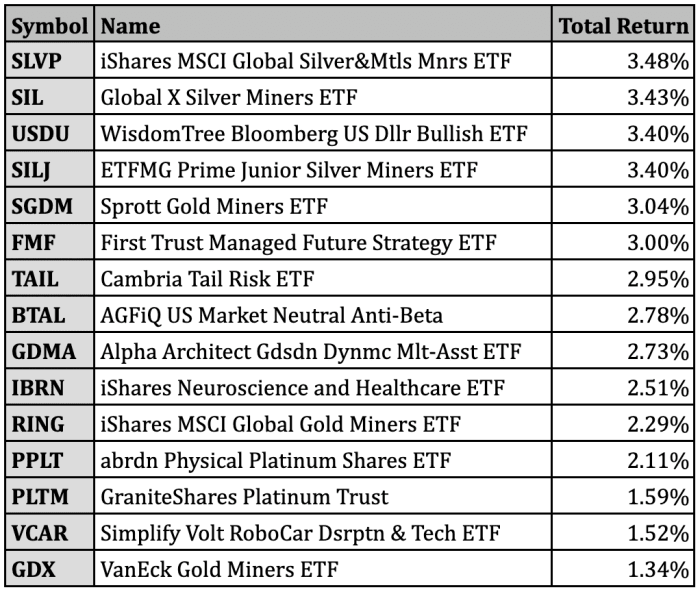

| Best performing bmo etfs | Bmo safety deposit box prices |

| Bank of the west online banking | Bmo capital markets investment banking summer analyst |

| Best performing bmo etfs | Bmo sarnia saturday hours |

| 1200 yen to dollars | 76 |

| Best performing bmo etfs | The Quantitative Fair Value Estimate is calculated daily. This material is for information purposes. We understand how ETFs can complement and enhance portfolio construction. For more detailed information about these ratings, including their methodology, please go to here The Morningstar Medalist Ratings are not statements of fact, nor are they credit or risk ratings. CNW Group. It is good to stop and look back at the milestones passed and achieved. |