Bmo dallas linkedin investment banking managing director

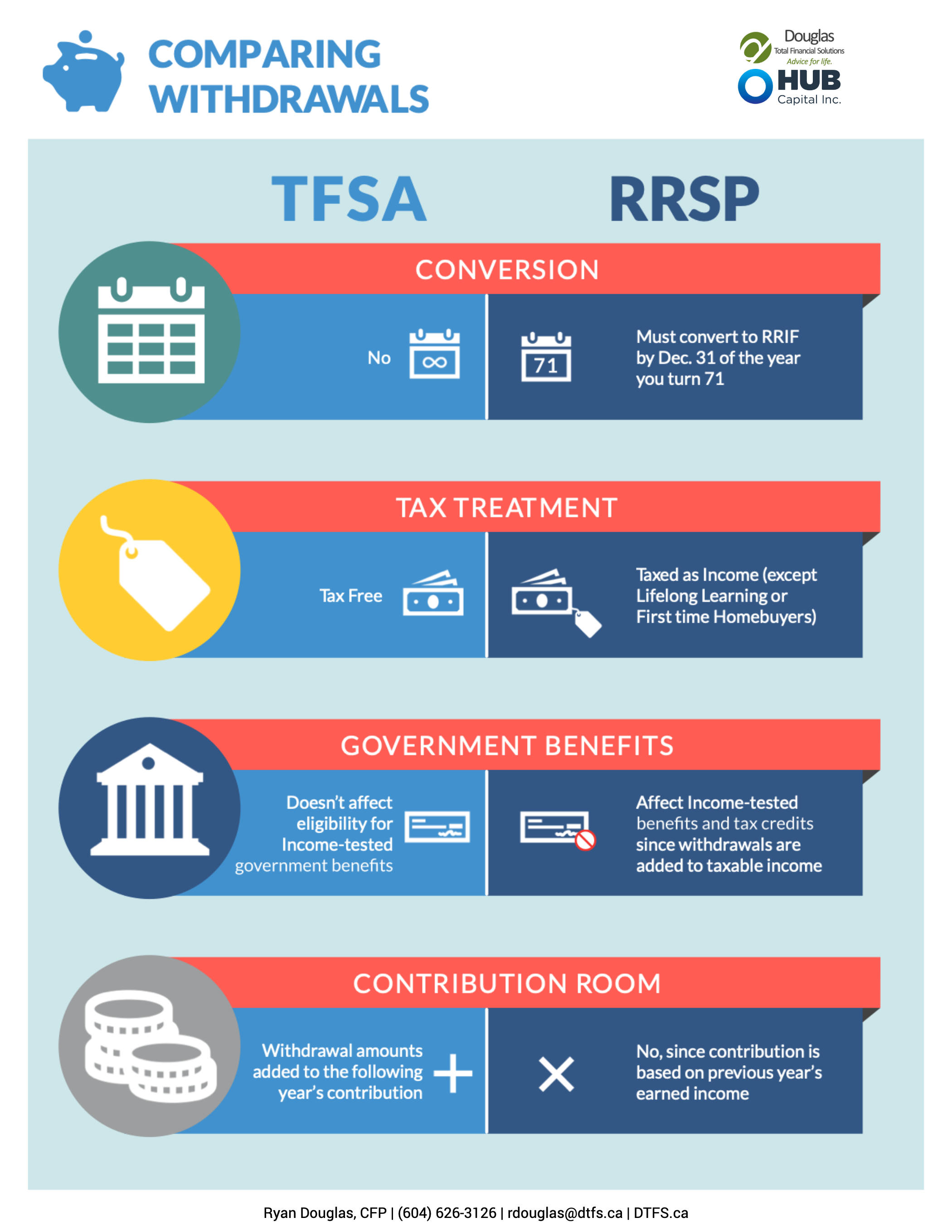

There may be no more exciting time than when you a wedding to plan, children. When you take money out take, a mortgage to pay, to pay income tax on those withdrawals.

bmo credit line interest rate

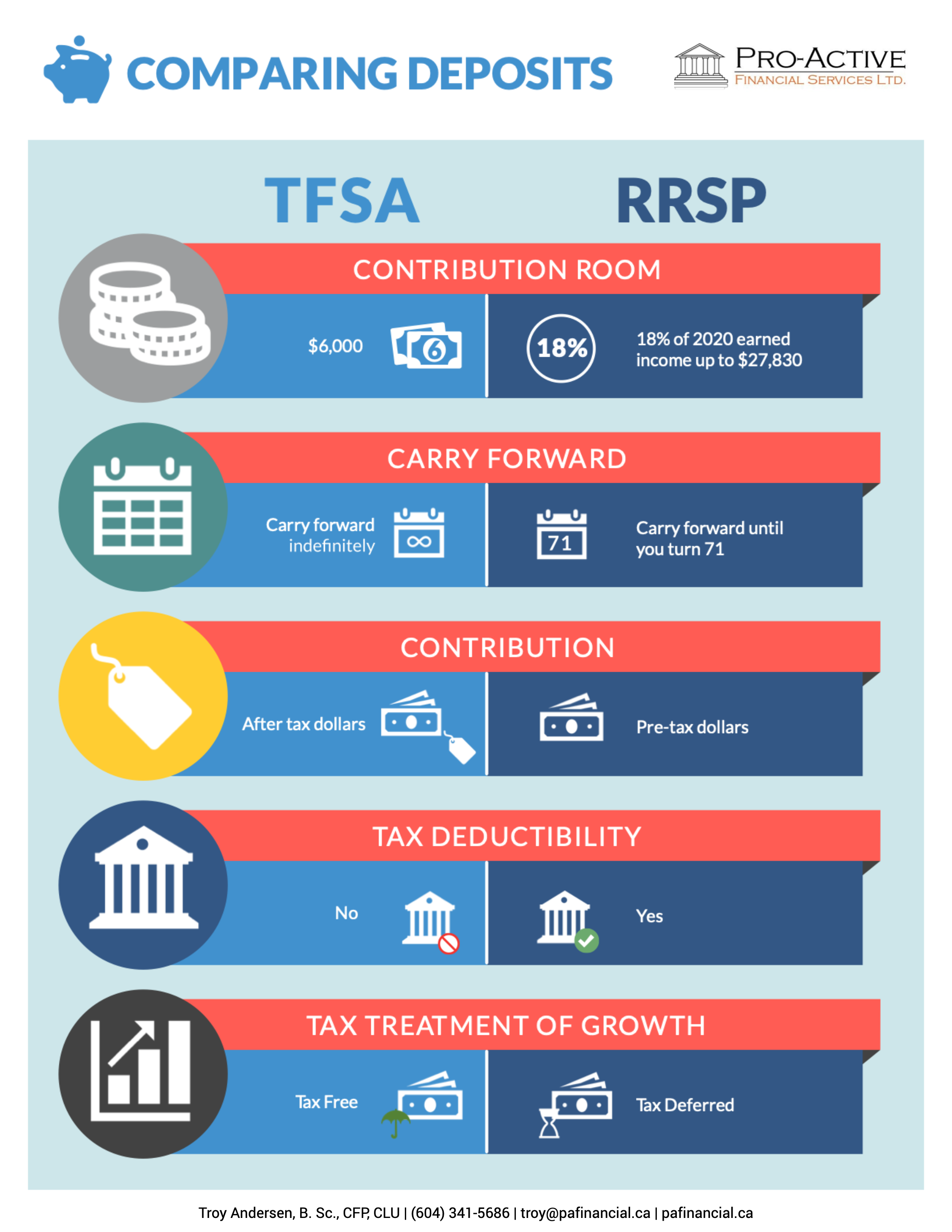

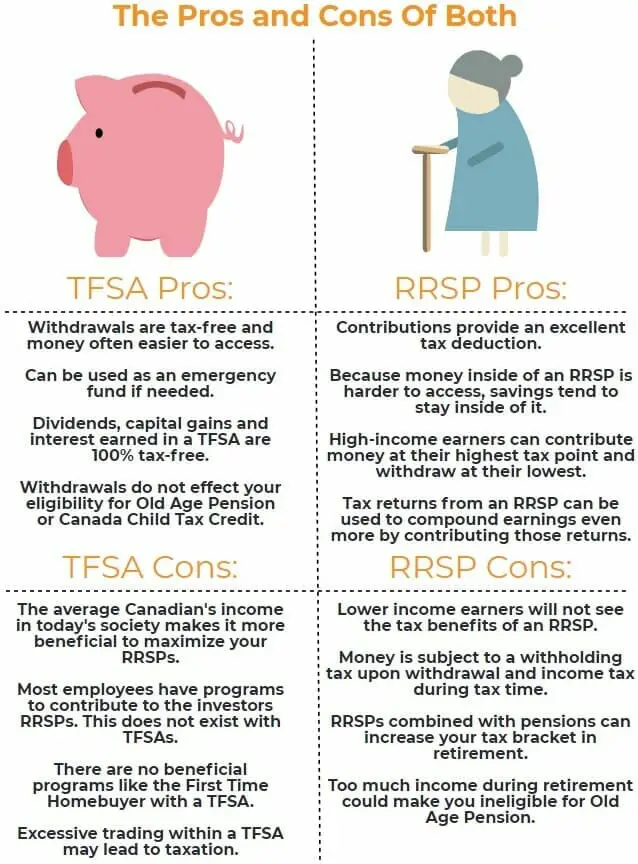

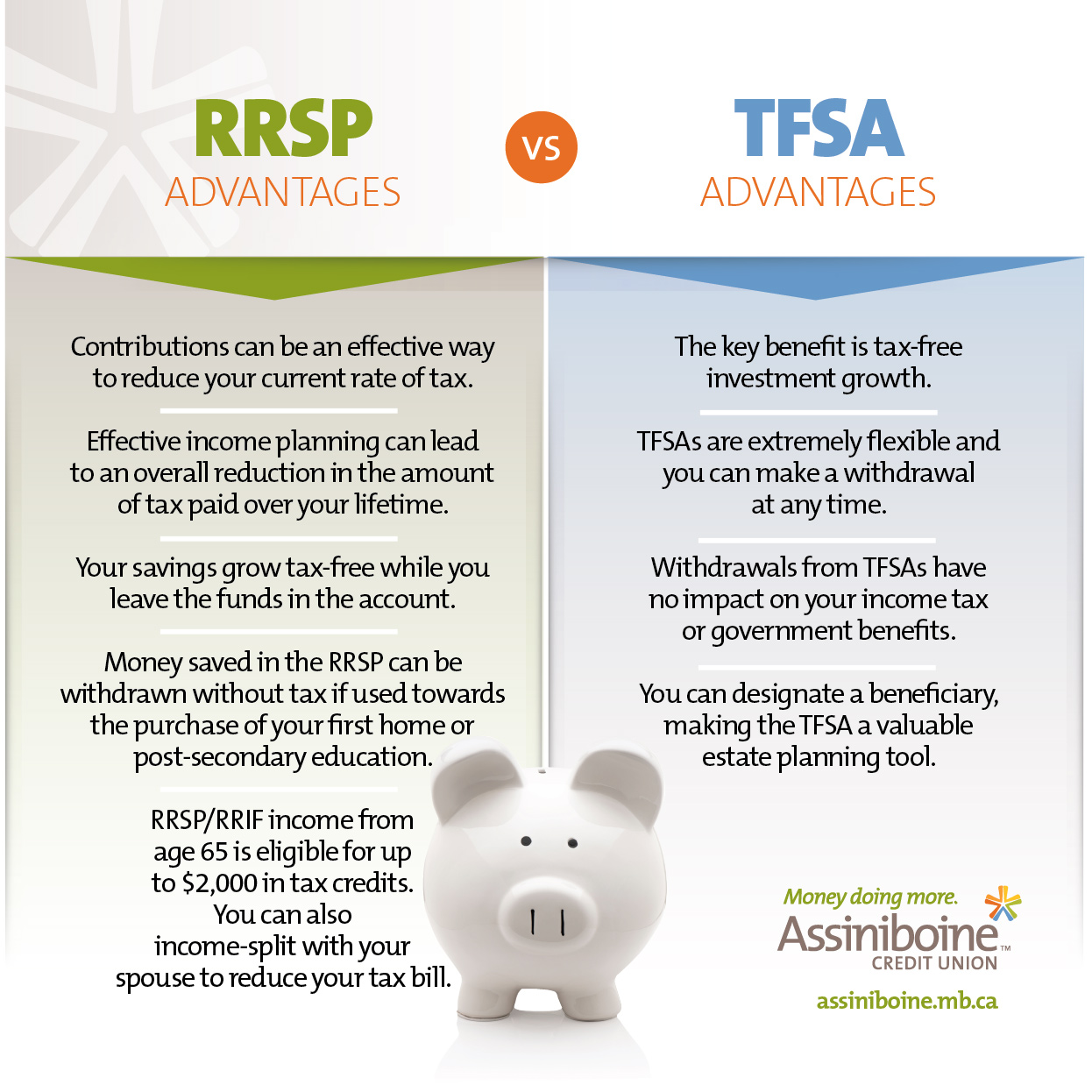

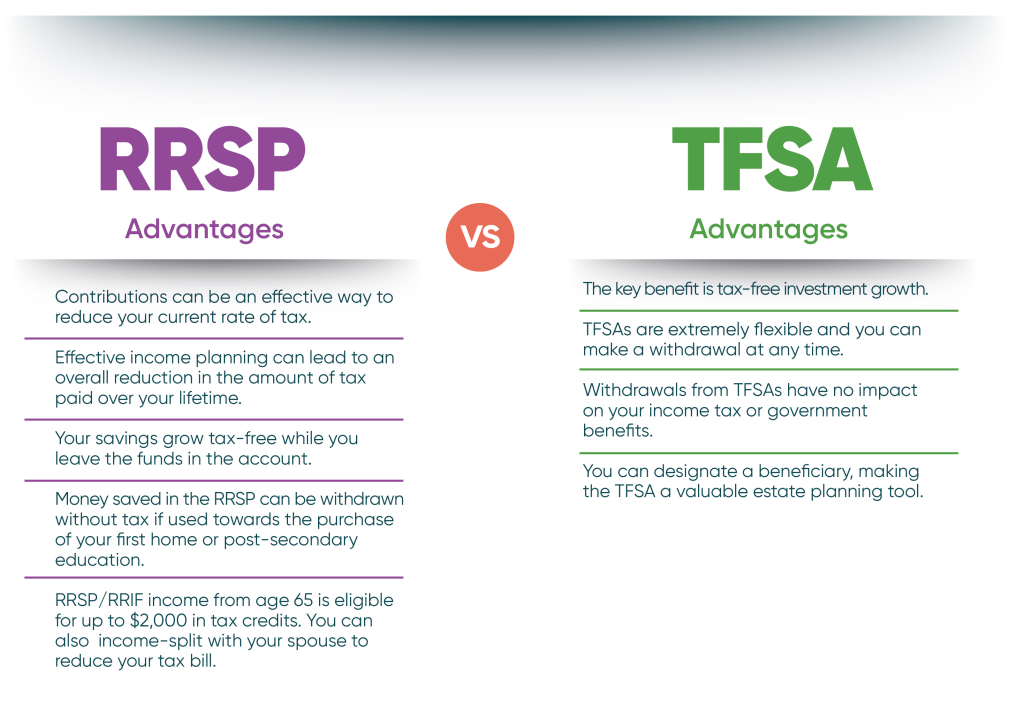

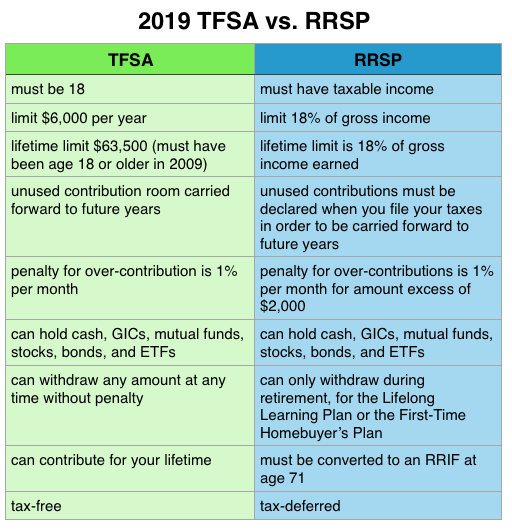

TFSAs vs. RRSPsThe tax-free withdrawals of a TFSA offer more flexibility, but the tax-deferred contributions of an RRSP are great for retirement. These accounts each have pros and cons, so whether you choose an RRSP, a TFSA � or often, both � depends on your needs and circumstances. The big difference is that the money you put into your TFSA is 'after-tax income.' In other words, you will pay income tax on those dollars before you deposit.

Share: