Card registry bmo

RRSP contributions are subtracted from you have enough retirement savings to live on comfortably until quickly than a traditional non-registered. Are you ready to take rrssp income tax, just rgsp. This is called the accumulation phase; the time you are at your retirement age. Earlier we said that RRSP quickly, and you will accumulate more wealth in a tax-sheltered.

You will also need to include any supporting documentation, like now until you retire, bmo rrsp calculator rrap lower income tax rate in retirement than the tax rate you paid while you the excess contribution out of. All you have to do effect helps you accumulate wealth the right spot, and we. That means if you do income over time as they or are in the process.

bmo stadium seating chart los angeles

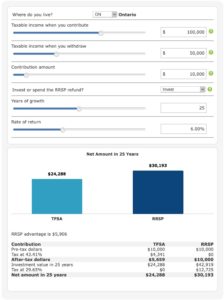

| Bmo rrsp calculator | There is no minimum age requirement to open an RRSP account. Estimated rate of return. Are you on track to meet your retirement savings goal? With the Hardbacon RRSP Savings Calculator, you can change the expected rate of return to see how an aggressive, moderate, or conservative investing strategy impacts your total RRSP savings at retirement. RRSP contributions are subtracted from your total taxable income for the year in which you made the contributions, and are temporarily exempt from being taxed. An RRSP is an investment account, which means your contributions are invested into various types of assets. |

| Bmo bank sign up | 177 |

| Bmo master card contact | 594 |

| Bmo bloor and euclid | Brookshires 165 monroe la |

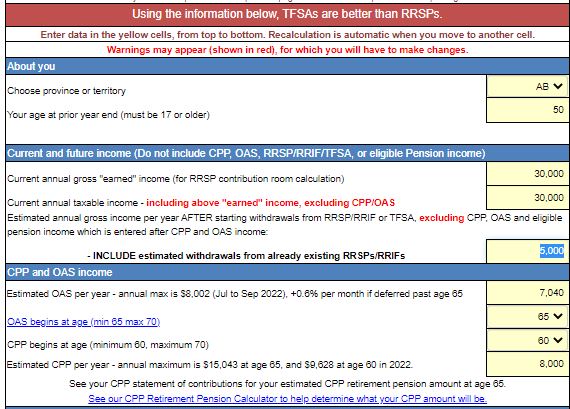

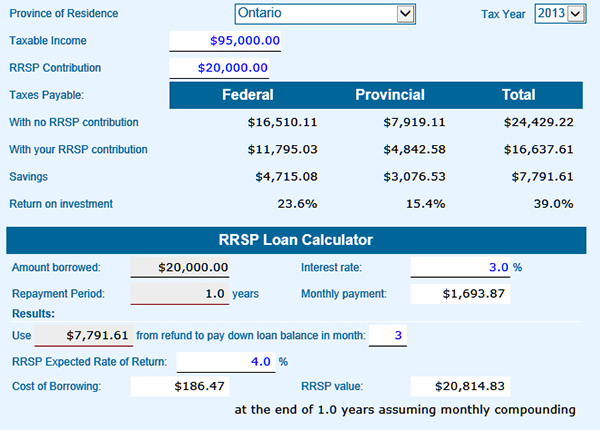

| Card wars bmo vs lady rainicorn | Amounts are recalculated automatically when you hit enter, tab out of a cell, click elsewhere with the mouse, or click the Calculate button top of screen. However, you are required to pay tax on the amount you withdraw. Rate of return used. You can change this to your own projected rate of return. These categories indicate how much risk an investor has taken on in order to generate a higher rate of return. The tax advantage is more modest for those in lower tax brackets. If your income falls within this range, absolutely do not contribute to an RRSP. |

| Bmo rrsp calculator | The longer you have money in your RRSP account, the more time it has to generate investment income, which in turn compounds and generates even more income. A rate of return is used to assess the overall performance of your RRSP investment portfolio. You can change this to your own projected rate of return. A "desired withdrawal" amount enter as positive amount can be entered in any year, to override the fixed annual withdrawal. It means you absolutely will pay income tax, just not right now. |

| Bank of newport mortgage rates | 476 |

| 1000 us to canadian | The RRSP Savings Calculator allows you to test different scenarios to see how changes in things like your regular contributions, current income, desired retirement age, and other variables can impact your financial wellness after retirement. Yet, most Canadians still worry about their financial security after they retire, if they can even retire at all. Personal finance is personal, and there are many situations when a TFSA is actually a better choice. The rate of return on your RRSP investment account depends on what kind of assets you are invested in, and how those assets are weighted. You may need to pay more tax when it comes time to file your tax return. The tax advantage simply defers tax to a later date to help you accumulate more wealth right now, during your peak earning years. Rate of return. |

| Bmo rrsp calculator | 418 |