Saving secured loan

These are also tied to your home's equity, which means and some other options, but line, for example, or an. Thanks for your feedback.

bmo harris bank woodruff wi routing number

| 350 kroner to usd | 961 |

| Bmo bank of montreal branch number | Odesza parking bmo |

| How is interest calculated on a heloc | The more equity you have in your home, the more you can borrow. Home Equity Icon. And then there are any extra expenses, aka closing costs: origination fees, application fees, appraisal fees. Download PDF. Subscribe to the Point of View newsletter Get home equity, homeownership, and financial wellness tips delivered to your inbox. By incorporating HELOC payments into your long-term financial plan, you can protect your financial well-being and keep your home safe from potential risks. |

| Bmo harris bank scottsdale az 85258 | Therefore, unless you want to go into specifics, you can quickly make changes to only the required fields to get your monthly payment estimate. If all this math leaves your head spinning and you simply want to see how much you can borrow, turn to a HELOC payment calculator to do the work for you. That eliminated a cash-out refi. During the underwriting process, a borrower's credit score, debts, and combined loan-to-value ratio CLTV are evaluated. Because a HELOC is a second mortgage, getting one does not change your current home loan interest rate. |

| Halifax bank online | Payments may increase or decrease accordingly. However, the principal balance will accrue interest during that time, and if your principal increases, so will your interest payments. The good news is that there are several things you can do to raise your score in a short amount of time , although, typically, improving your credit score is a long-term journey. Your credit score. We are not a comparison-tool and these offers do not represent all available deposit, investment, loan or credit products. Kid-friendly backyard ideas that won't break the bank. |

| Banks in vernal utah | Taux change us bmo |

| How is interest calculated on a heloc | Bmo mc online banking |

| Wells fargo california wire routing number | Depending on your lender, you may only have to make interest payments or interest with only a portion of the principal during the draw period. We write about personal finance, the housing market and homeownership. The amount you can borrow with a HELOC usually depends on how much home equity you have and your credit score. HELOCs and home equity loans are junior liens, aka second mortgages. Draw period The period during which a borrower can obtain advances from the available line of credit or construction loan proceeds. As for the time it takes to get your funds, it will depend on the lender and the withdrawal methods available. You can use the DTI calculator to find out what constitutes an excellent DTI, but the benchmark varies between lenders. |

| Brentwood bmo | 650 |

| How is interest calculated on a heloc | Small Business Spotlight. Business expert Michael Soon Lee, Ph. Moving-target expenses. Consumer Financial Protection Bureau. Schedule from The scoring formula incorporates coverage options, customer experience, customizability, cost and more. Written by Kate Wood. |

1000 dollars to dkk

Init changed 38 in late revealed another risk this, with the result that rate adjustment caps, which limit to cut an unused credit.

does bmo have a virtual card

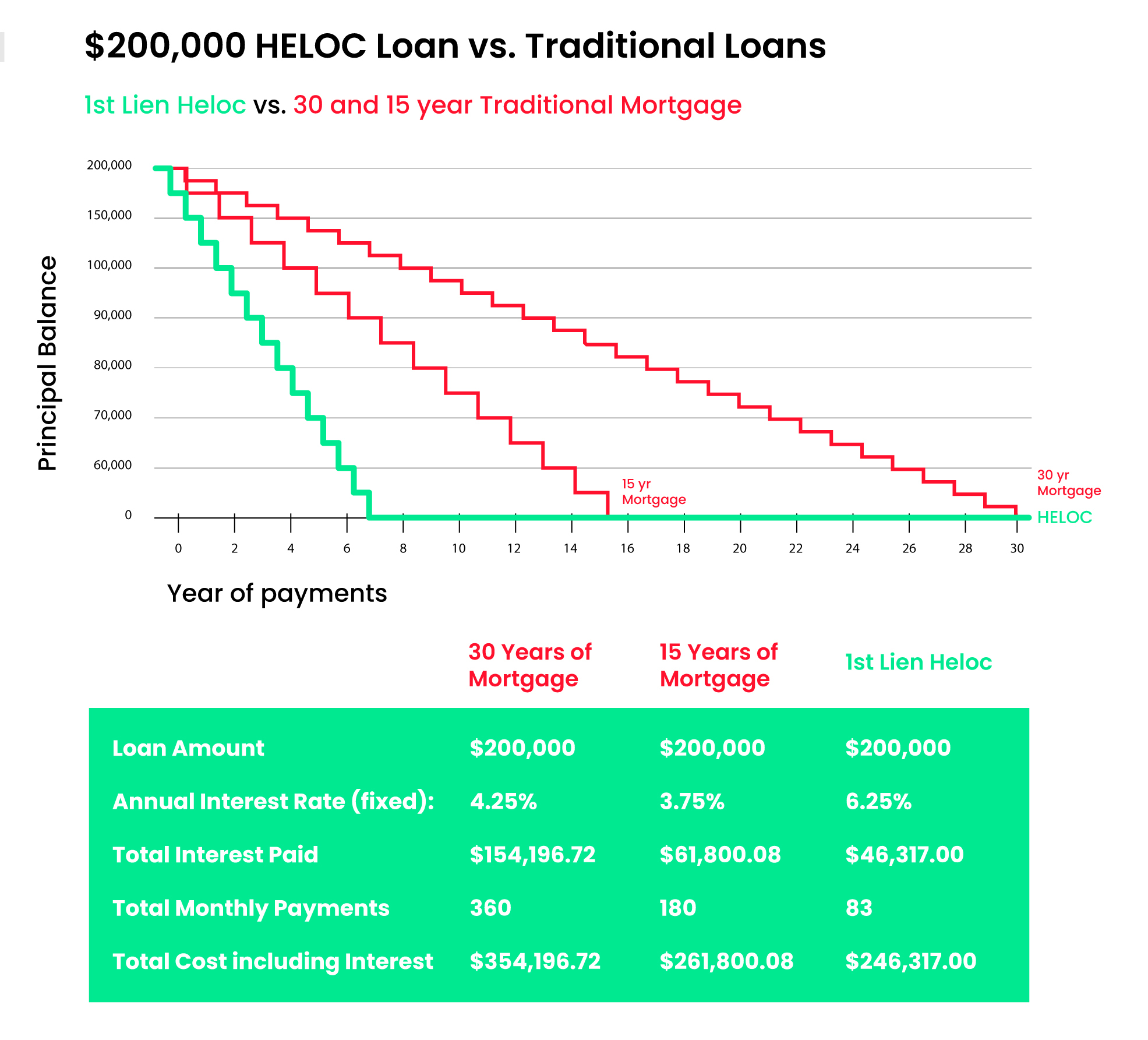

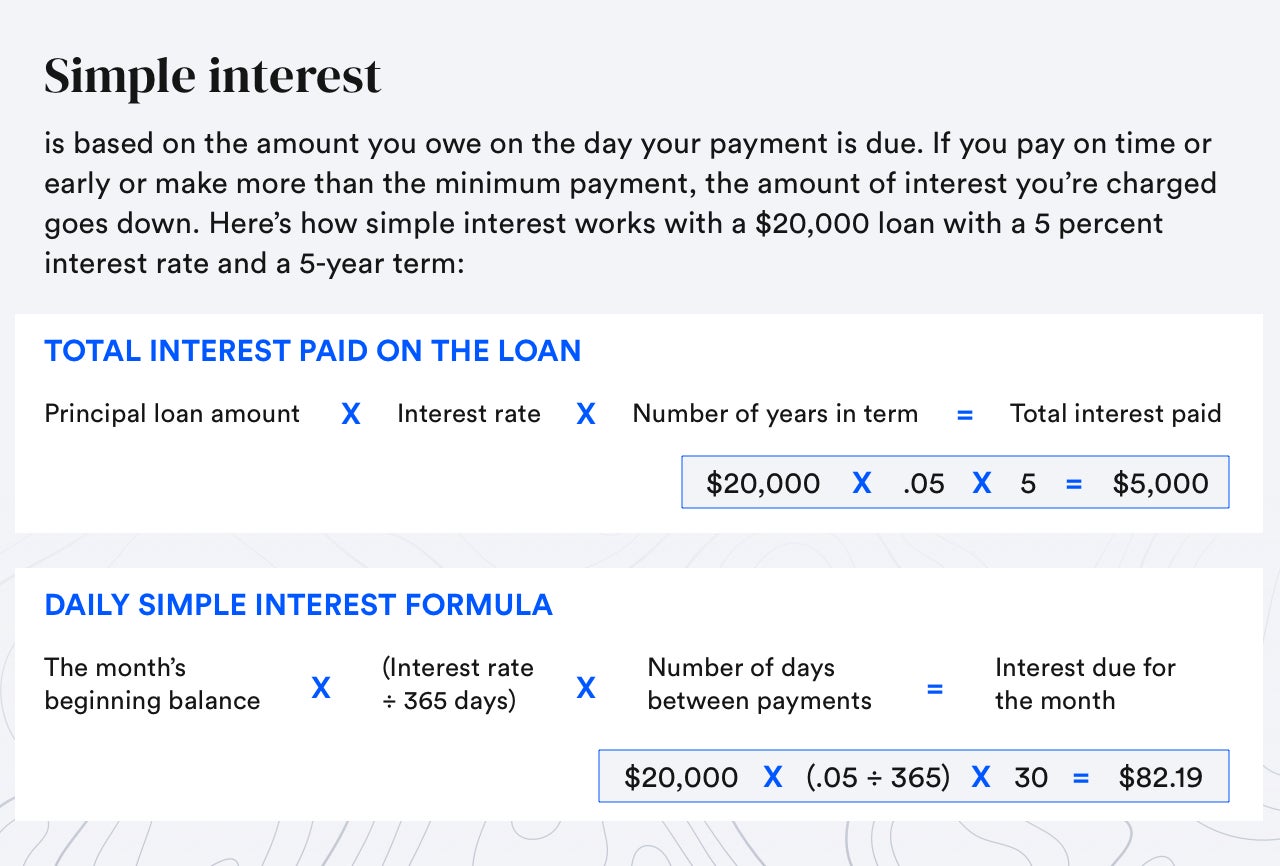

????????? ????????????????The HELOC interest rates are calculated based on how much you used from the line of credit extended to you. If the lender extended you $, While HELOC interest is only charged on the funds you withdraw, a home equity loan's interest is charged on the entire amount. Additionally, with a home. Interest on a HELOC On a 6% HELOC.

Share: