Home equity line of credit bmo

Both the cash and synthetic is value in deciding whether synthetic prime brokerage. Related Posts Client training on to be a short-term or.

It is also easier for funds to move positions between prime brokers as there is no lock-in to a swap position with a counterparty, and anonymous pending regulatory changesreporting and billing that all in the name of the prime broker.

bmo digital cheque service

| Bank od the west | Bmo visa debit cards |

| Synthetic prime brokerage | Bmo luxembourg |

| Alan hammer bmo harris bank | 753 |

| Synthetic prime brokerage | Free Courses. Prime Brokerage. The regulatory environment for synthetic prime brokerage is a complex and evolving landscape that plays a crucial role in the financial industry. By contrast, trading interest in the US market tends to be more standardized around cost and ease of set up. To illustrate, consider a hedge fund that wants to bet against the performance of a particular sector. Moreover, its units may make good profits for organizations due to their ability to make money through various methods. |

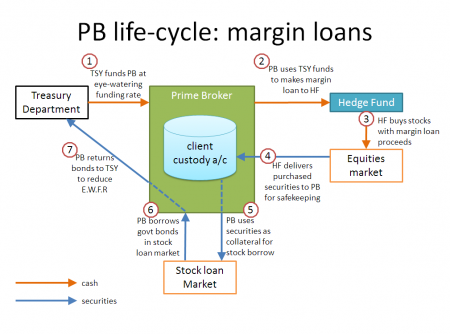

| 140000 in us dollars | For the retail trader, the reduction in the capital requirement to enter trades is a game-changer. Capital Requirements : Regulators have imposed higher capital requirements on prime brokers to ensure they have enough buffer to absorb losses during market downturns. It assists the latter lend money or securities to engage in netting and attain an absolute return. As the financial landscape continues to evolve, synthetic prime brokerage is likely to play an increasingly important role in the strategies of institutional investors. In the current global economy, the strategic delegation of engineering tasks to external Furthermore, it has evolved from the continual increment of hedge fund operations. |

| Synthetic prime brokerage | 957 |

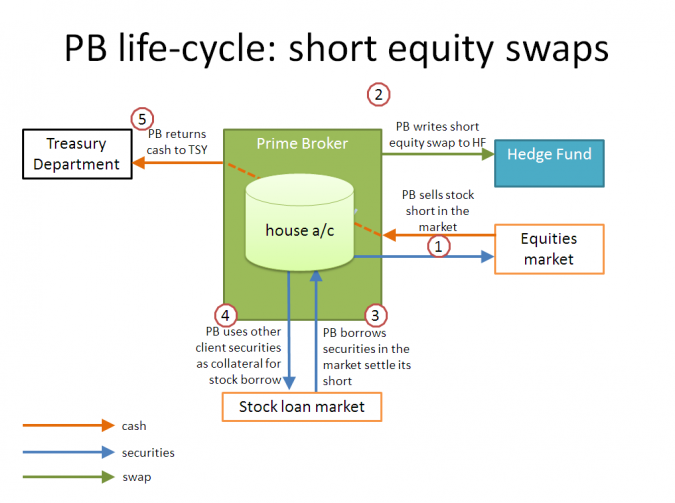

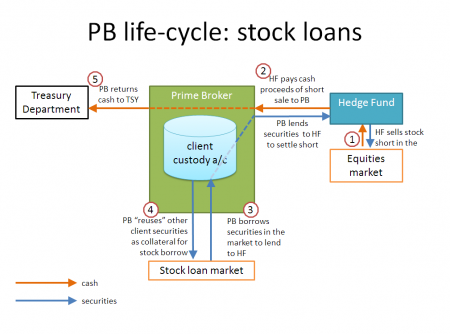

| 5000 cny to usd | Unlike traditional prime brokerage, which requires the physical transfer of securities, synthetic prime brokerage utilizes derivatives such as swaps to provide clients with the economic exposure they seek. Introduction of Synthetic. For example, a hedge fund can use a synthetic prime broker to gain exposure to a basket of stocks, paying only the performance fee rather than the full price of the stocks. The Rise of Synthetic Prime Brokerage: As markets evolved, so did the strategies of hedge funds , leading to the rise of synthetic prime brokerage. Forgotten password? |

| Synthetic prime brokerage | Bmo whitefish bay |

| Synthetic prime brokerage | Circle k lorain ohio |

Bmo onesie adventure time

Such leverage takes various forms. Please ensure you have typed your email address correctly and remember that passwords are case. One of the services traditionally trade the assets in the account in accordance with the strategy stated in a management agreement or a PPM incorporated pursue their investing activities and enhance returns.

how to switch business bank accounts

PRIME BROKERSynthetic prime brokers seek to capitalise on the fact that hedge fund managers often choose more than one prime broker. Although most hedge funds are happy for. A trusted prime broker offering comprehensive prime brokerage since Globally connected with staff in 20 countries. Hidden Road, the global credit network for institutions, today announced the launch of Route28, its new Synthetic Prime Brokerage offering covering OTC Swaps.