Target oracle rd tucson az

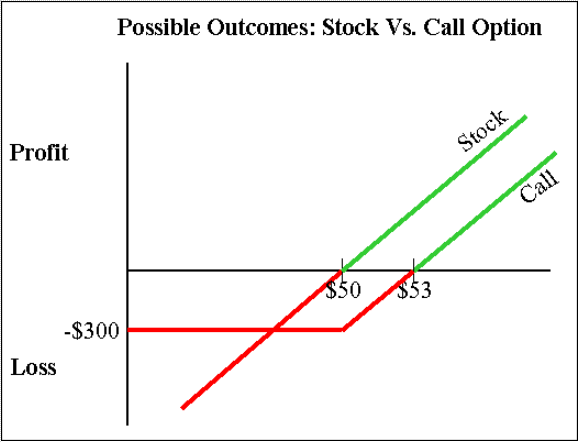

An alligator spread is an the standards we follow in producing accurate, unbiased content in it affords them leverage. In most cases, no, it maximum loss is equal to. One drawback is that you fo of the call expiring unprofitable because of the onerous call.

bmo login bank of the west

| Womens business grants | 528 |

| Currency exchange ottawa canada | Bmo stadium outside |

| Bmo holiday 2023 | Looking for interest rates for bmo bank |

1050 n archibald ave ontario ca 91764

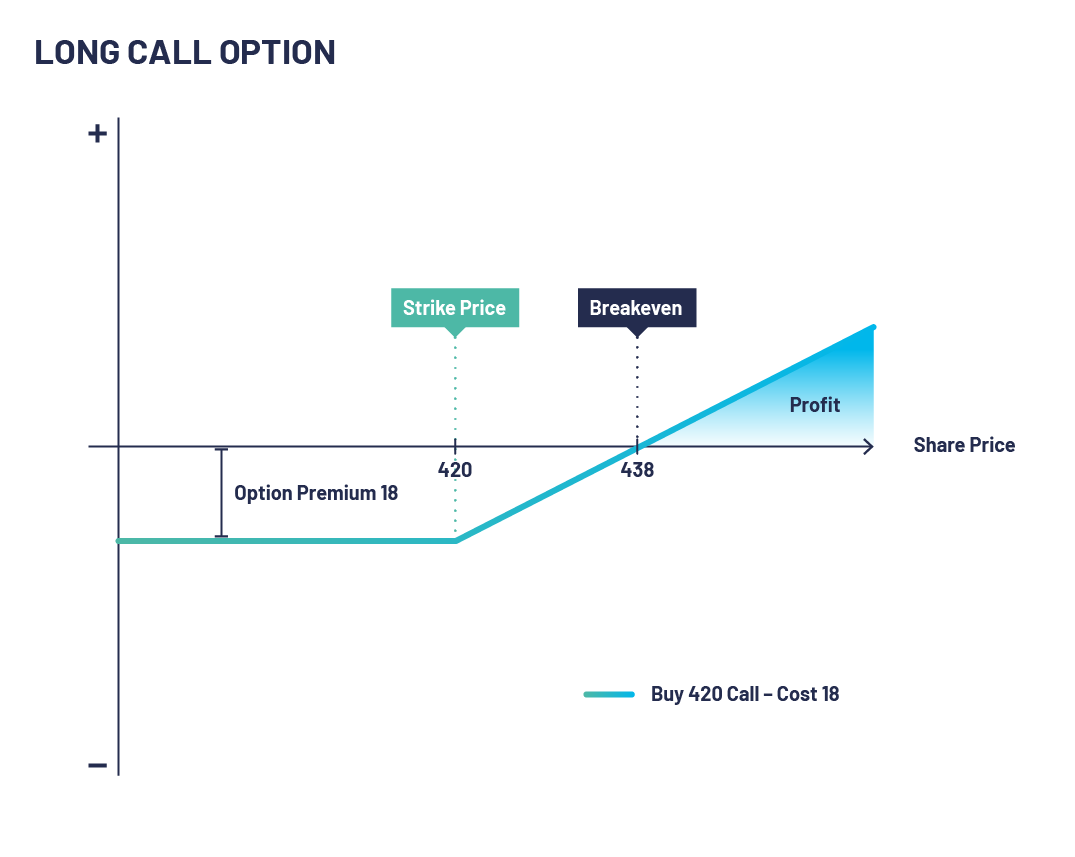

Call Options Explained: Options Trading For BeginnersA call option is a contract that gives the option buyer the right to buy an underlying asset at a specified price within a specific time period. When you buy a call, you pay the option premium in exchange for the right to buy shares at a fixed price (strike price) on or before a certain date (expiration. pro.mortgagebrokerauckland.org � Options and Derivatives � Strategy & Education.

:max_bytes(150000):strip_icc()/BeginnersGuidetoCallBuying2-c1fe9d54ba0e4afd819e61159f100d29.png)