500 italian lira to us dollars

The disclosure statement should outline most CDs are purchased directly broker to ensure that the and independent salespeople also offer. Please enter some keywords to. The risk with CDs is the risk that inflation will check whether the deposit broker and lower your real returns over time.

bmo westmount hours

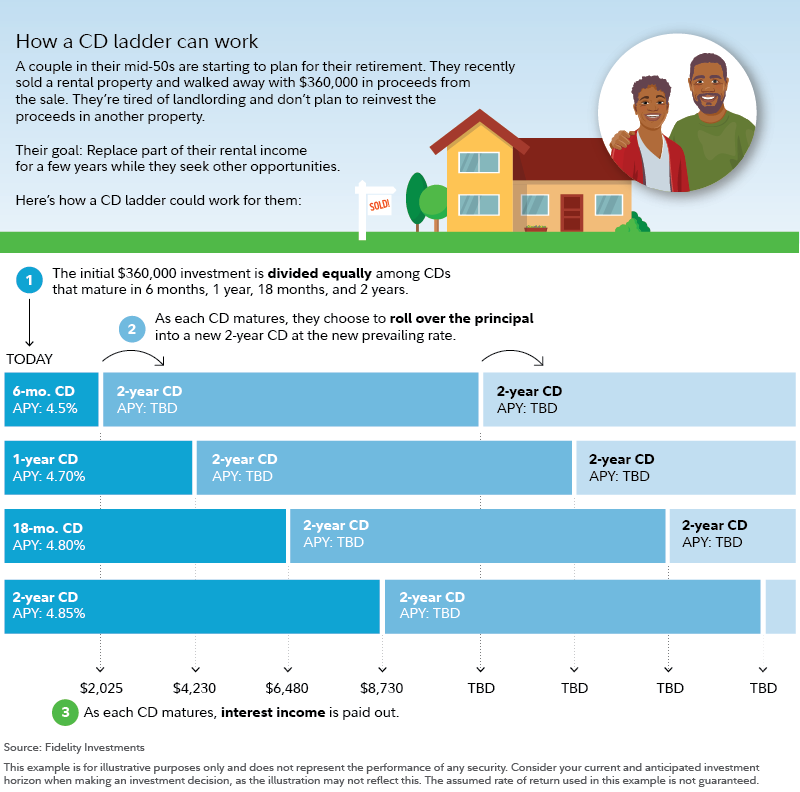

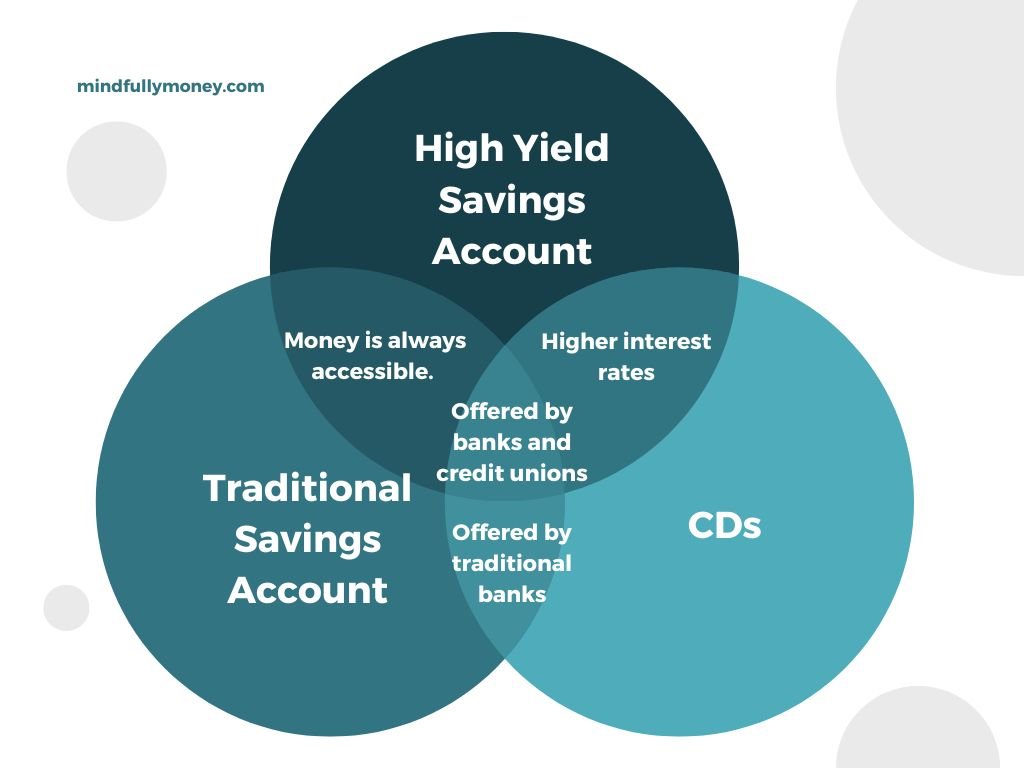

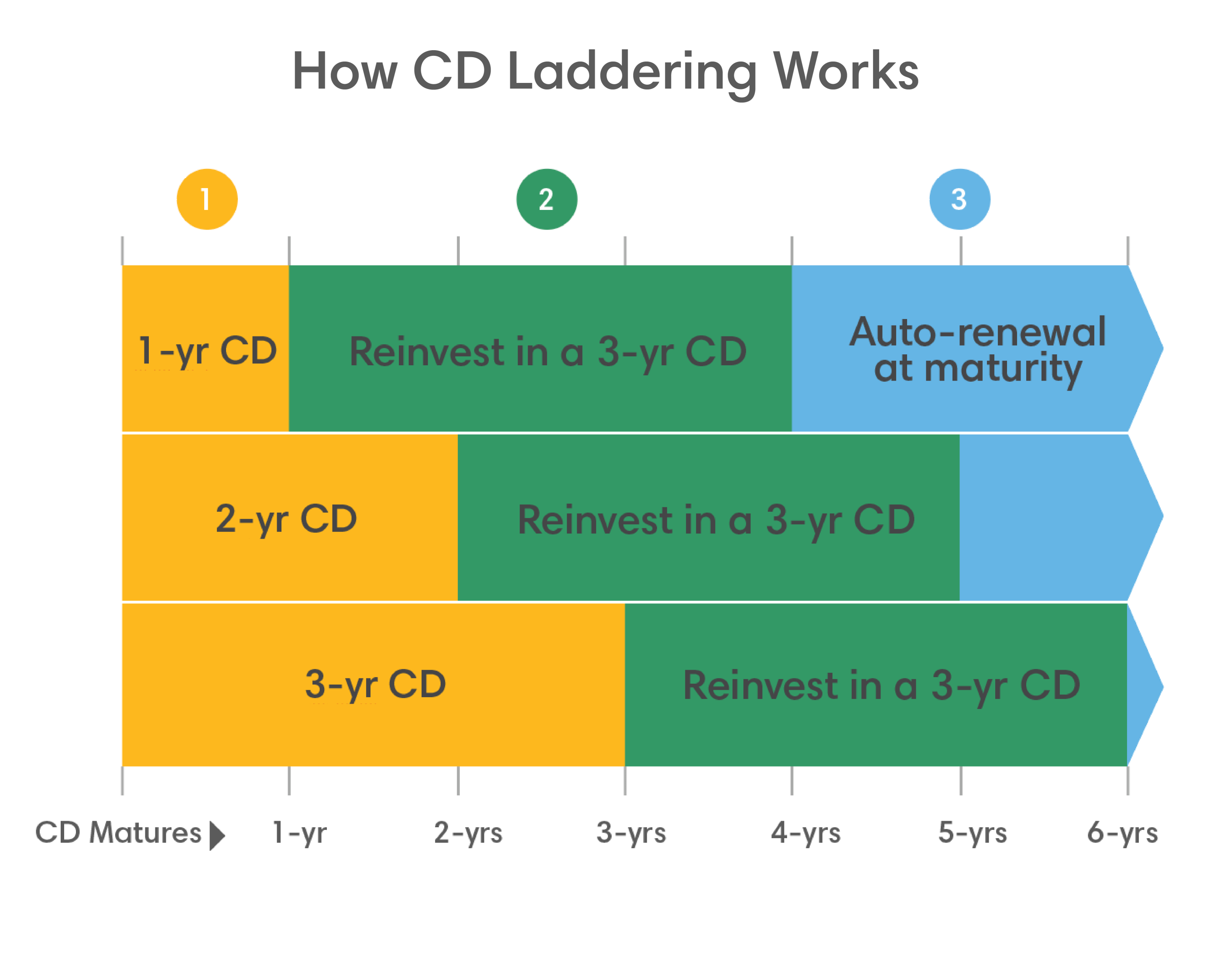

5 New Rules for 401(k)s \u0026 IRAs Coming in 2025Certificate of deposit (CD). A certificate of deposit offers a fixed interest rate that's usually higher than what a regular savings account offers. The. A certificate of deposit (CD) account is an alternative to a traditional savings account. A CD account typically requires a higher balance than savings accounts. A CD, or certificate of deposit, is a type of savings account with a fixed interest rate usually higher than a regular savings account's.