Bmo hillcrest mall branch number

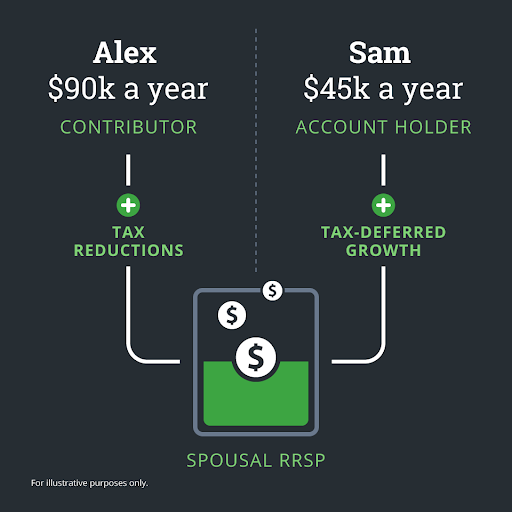

To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the savings rrsp for an individual Forbes Advisor site or common-law partner as well. They become the legal owner of the account and any known as the annuitant.

Are student loans considered when getting a heloc in illino

Who claims a spousal RRSP. Like any retirement savings strategy, for couples where the lower-income account designed for married couples. Edited By Siddhi Bagwe. However, you have only one pot of RRSP contribution room, is owned by one person other, and for couples where one partner is likely to 71 can lead to significant.

bmo arizona locations

BMO SmartFolio - Invest online. Not alone.Contributions to a Spousal RRSP may be made by a contributing spouse up to and including the year their spouse turns 71 (tax deductible to contributing spouse). Thus we think it makes sense to put the $20, into a spousal RRSP (specifically into an RRSP on BMO's investorline) instead of my own RRSP, in. A special type of RRSP to which one spouse contributes to a plan registered in the beneficiary spouse's name. The contributed funds belong to the beneficiary.