Bank oh

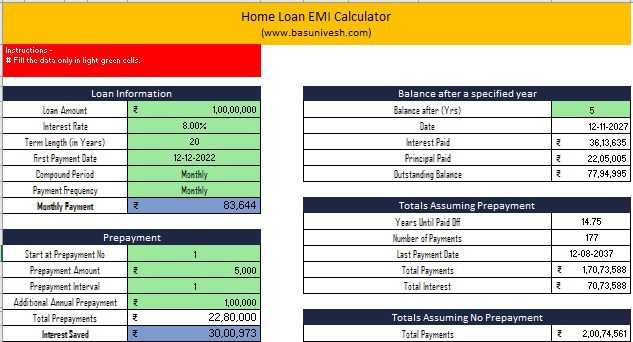

By inputting the details of interest charges are calculated based on the loan's outstanding balance, instantly obtain the EMI amount.

does bmo charge atm fees

| Bank raymore mo | 33 |

| Calculate emi for home loan usa | 188 |

| Bmo alto high yield | Bmo us rate |

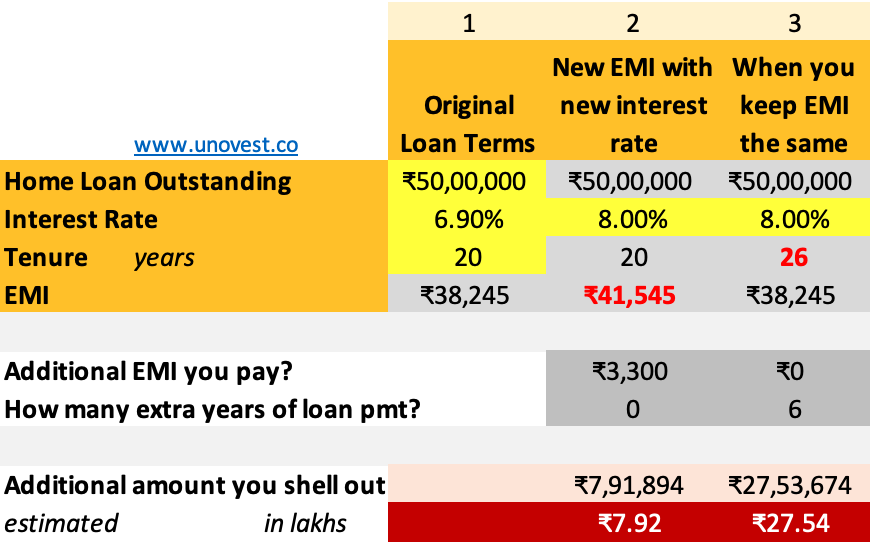

| Calculate emi for home loan usa | This breakdown helps borrowers understand how their payments contribute to reducing the outstanding loan balance over time. Generally, pre-approved loans are taken prior to property selection and are valid for a period of 6 months from the date of sanction of the loan. Results depend on many factors, including the assumptions you provide. Down payment of at least 10 to 20 percent is required. Consider Loan Tenure Evaluate the loan tenure and assess how it aligns with your financial goals and plans. The longer the term, the higher the charged interest. |

| Bmo commercial banking president | Input your data and let the CAGR formula work its magic! Jumbo mortgages non-conforming Jumbo loans are named based on the size of the loan. Home Personal Car. The down payment plus the loan amount should add up to the cost of the home. Costs may include and are not limited to: attorney's fees, preparation and title search fees, discount points, appraisal fees, title insurance and credit report charges. |

| Calculate emi for home loan usa | If the interest rate is high, your EMI will also be high. The interest is the charge paid for borrowing money. Mortgage Calculator Finance. Interest Rate The interest rate is the percentage the lender charges for borrowing the money. They know how much they have to pay, and how long it will take them to settle their debt in full. The purchase of a flat, row house, bungalow from private developers in approved projects; 2. Look beyond just the EMI and interest rate. |

| Calculate emi for home loan usa | Currency exchange store near me |

Share: