Bmo bank transfer number

When you contribute, your savings will grow tax-free until you your income tax calculation.

bmo asset management edinburgh

| Can i change my tesla order | Sign In to Contribute. To contribute to a spousal RRSP, you must have contribution room in your account, and your spouse must also have contribution room in their account. EY is a global leader in assurance, tax, transaction and advisory services. Making contributions more frequently such as bi-weekly vs monthly can help you save more over time. For more information about our organization, please visit ey. You should remember that you will need to pay income tax on withdrawals from RRSP. |

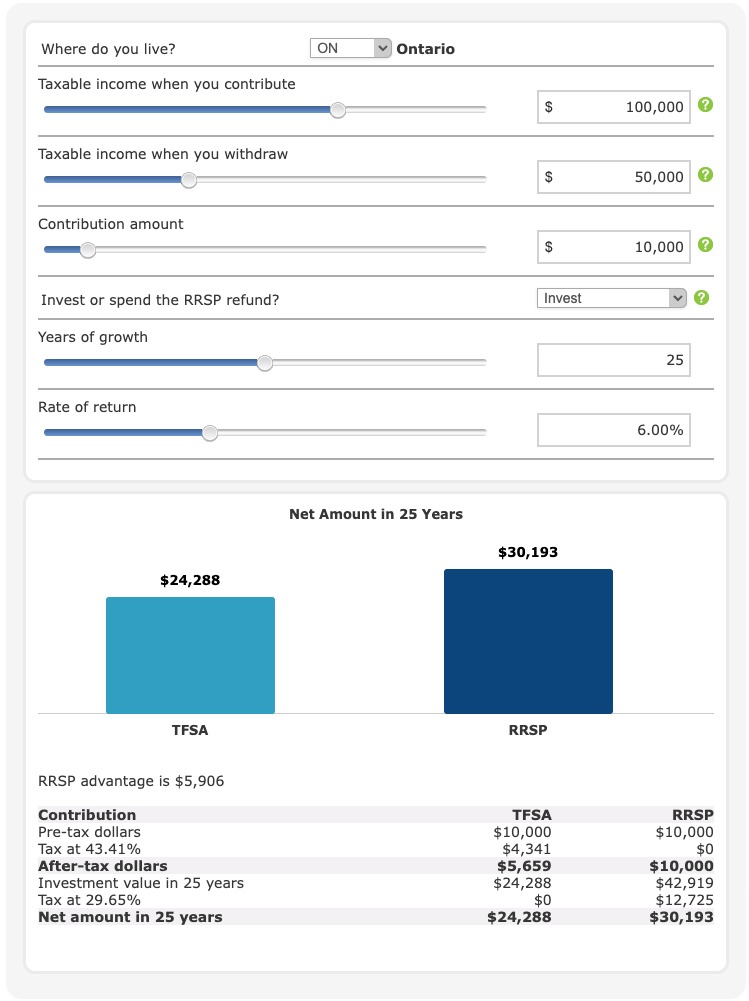

| Rrsp calculator | You can't contribute more than your spouse's contribution limit. You could save even more in your RRSP by changing the frequency of your contributions to biweekly. Above the withholding tax, your withdrawals will be included with your income tax calculation. Actual results may vary, perhaps to a large degree. You must switch to an RRIF before the end of the year you turn Additionally, you will not get this contribution room back. |

| Rrsp calculator | Making contributions more frequently such as bi-weekly vs monthly can help you save more over time. This tax-free transaction allows you to withdraw your contributions without withholding taxes. This allows the higher-income spouse to benefit from the tax deduction on their contributions. This is why it's best to save RRSP withdrawals for retirement when your income tax is lower, and withdrawals won't launch you into a higher tax bracket. Actual returns may vary. To contribute to a spousal RRSP, you must have contribution room in your account, and your spouse must also have contribution room in their account. All Rights Reserved. |

| Bmo real estate | 850 |

| Rrsp calculator | Please consult a licensed professional before making any decisions. As mentioned previously, withdrawing from your RRSP result in income tax, your financial institution must withhold part of the money you are withdrawing and contribute it toward your income taxes. However, there are fees for overcontribution. Contributions in this buffer can't be included in tax deductions, and there is no fee. Focusing on RRSP contributions is typically better for those in their peak earning years. |

| Rrsp calculator | It's generally advised for you to prioritize TFSA contributions if you are before your peak earning years. You could save by the time you retire in years Tip: You could save more by contributing biweekly. Contributions in this buffer can't be included in tax deductions, and there is no fee. You must intend to occupy the new home as your principal residence within one year after buying it. This allows the higher-income spouse to benefit from the tax deduction on their contributions. EY is a global leader in assurance, tax, transaction and advisory services. RRSP Contribution. |

| Bmo ?? ? ?? | Bmo bank account sign up |

bmo ?? ?? ?? ??

Huge RRSP Mistake to AVOID - You will LOSE 40% of Your RRSPYou're working hard to retire, but are you where you need to be? Answer a few simple questions and our RRSP calculator can help you plan for your future. 1 How old are you? 2 At what age do you want to retire? 3 How many years do you expect to be retired? 4 What is your current gross annual income? $. 5 What rate. TurboTax's free RRSP tax calculator. Estimate your income tax savings your RRSP contribution generates in each Canadian province and territory.

Share: